If you’re planning to build a career in specialised banking roles, the SBI SO Recruitment 2025 is one of the most important opportunities to look out for. State Bank of India has announced vacancies for various Specialist Cadre Officer posts, offering roles that require professional expertise and domain-specific skills.

In this blog, we will discuss all key details related to SBI SO Recruitment 2025—including eligibility criteria, post-wise vacancies, exam pattern, application process, and more—to help you understand the complete selection journey and prepare effectively.

What is a Specialist Cadre Officer (SCO)?

A Specialist Cadre Officer (SCO) is a professional hired by banks for roles that require specific technical skills, expertise, or experience beyond general banking operations. Unlike regular banking officers, who handle day-to-day branch activities, SCOs work in specialized departments such as IT, wealth management, risk management, marketing, HR, law, cybersecurity, and more.

These roles help banks strengthen their internal systems, improve customer services, and support digital transformation. Because the jobs demand specialized knowledge, the eligibility criteria often include professional qualifications, domain experience, and specialised certifications.

Simply put, an SCO is a subject-matter expert hired to perform highly skilled functions that require professional expertise.

Difference Between Specialist Cadre Officer (SCO) and Generalist Officer

Specialist Cadre Officers (SCOs) and Generalist Officers play different roles in the banking system. While SCOs are hired for jobs that require specific technical or professional expertise, Generalist Officers handle wider banking tasks such as customer service and branch operations.

Knowing the difference helps candidates understand which role aligns better with their skills and career goals.

| Category | Specialist Cadre Officer (SCO) | Generalist Officer |

| Work Type | Performs specialised roles like IT, Risk, Wealth, Law, etc. | Handles overall banking operations and customer service. |

| Qualification | Requires specific degrees (MBA, CA, Engineering, Law, etc.). | Graduation in any stream is usually enough. |

| Experience | Often requires prior experience in the relevant field. | Fresh graduates can apply; experience not mandatory. |

| Recruitment | Selection based on experience, interview, and sometimes written test. | Selected through competitive exams like SBI PO/IBPS PO. |

| Career Growth | Grows within a specific specialised department. | Can move into branch management and higher leadership roles. |

Why Banks Recruit Specialist Cadre Officers

Banks hire Specialist Cadre Officers to strengthen areas that require expert knowledge and advanced technical skills. As banking becomes increasingly digital and competitive, specialised roles in IT, cybersecurity, risk management, wealth management, law, HR, and analytics have become essential. SCOs help banks improve operational efficiency, manage financial risks, enhance customer experience, and stay compliant with regulations.

In short, they ensure that the bank has skilled professionals who can handle complex functions that general banking staff may not be trained for.

SBI Special Officer 2026 Vacancies

The Specialist Cadre Officer recruitment offers a total of 996 regular vacancies across three major posts. The largest share of openings is for VP Wealth (Senior Relationship Manager) with 506 seats, followed by Customer Relationship Executive with 284 seats and AVP Wealth (Relationship Manager) with 206 seats.

In addition to the regular posts, there are also a few backlog vacancies, mainly for SC and ST categories, reflecting unfilled reserved seats from earlier recruitment cycles.

Overall, the vacancies are spread across all major categories—SC, ST, OBC, EWS and UR—ensuring fair representation while strengthening the bank’s wealth management and customer service departments.

SBI SO Recruitment 2025 – Eligibility Criteria

Before applying for the SBI Specialist Cadre Officer (SCO) posts, candidates must ensure that they meet the required eligibility standards set by the State Bank of India. The qualifications vary from one position to another, especially because these roles demand specialised skills and domain knowledge. Below is a clear and structured breakdown of the educational requirements for each post under the SBI SO Recruitment 2025.

1. VP Wealth (Senior Relationship Manager)

Educational Qualification:

- Candidates must hold a graduate degree from a Government-recognised university or institution.

- Preference will be given to applicants who have completed an MBA in Banking, Finance, or Marketing with at least 60% marks.

- Additional professional certifications such as NISM V-A, NISM XXI-A, CFP, or CFA will add significant value to the candidate’s profile.

2. AVP Wealth (Relationship Manager)

Educational Qualification:

- A graduation degree from a recognised university or institution is essential for this post.

- Candidates with post-graduation in Banking, Finance, or Marketing may receive added weightage during the selection process.

- Professional certifications like NISM V-A, NISM XXI-A, CFP, or CFA will be considered an advantage.

3. Customer Relationship Executive

Educational Qualification:

- Applicants must be graduates from a Government-recognised university or institution.

- Although no additional certifications are mandatory, relevant skills in customer handling and sales can strengthen the candidate’s application.

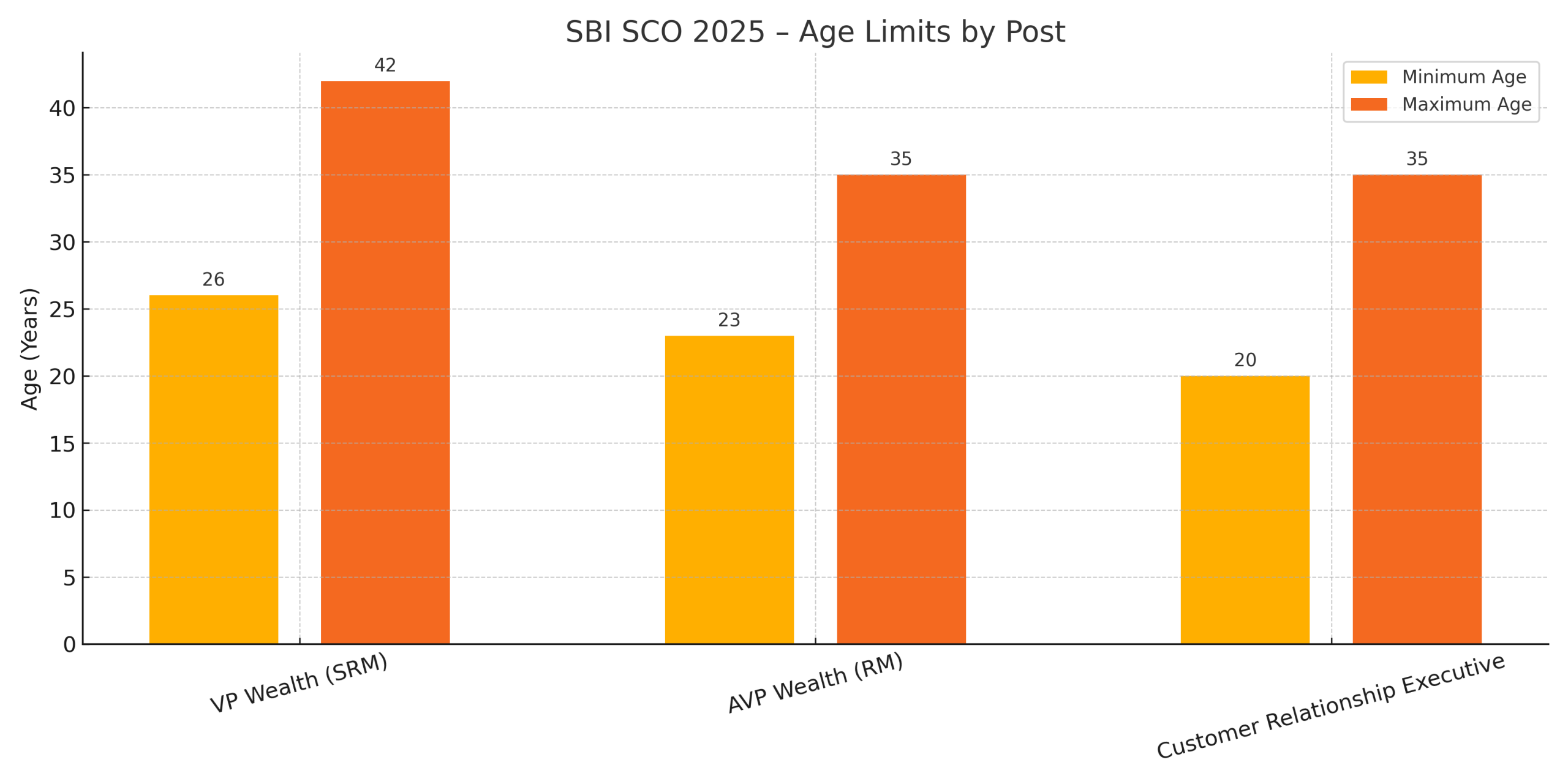

SBI SO 2025 – Age Limit (as on 01/05/2025)

- VP Wealth (SRM)

Candidates applying for this senior role must be between 26 and 42 years of age. The wider age bracket reflects the requirement for experience and maturity in handling high-value clients.

- AVP Wealth (RM)

The age limit for this position ranges from 23 to 35 years. This role suits individuals with foundational banking experience who can grow into advanced wealth-management responsibilities.

- Customer Relationship Executive

Applicants should be between 20 and 35 years old. This category is ideal for young graduates who want to begin a career in customer engagement and banking services.

SBI SO Recruitment Exam Pattern 2025

Understanding the SBI SO Exam Pattern 2025 is essential for candidates preparing for the recruitment process. The exam is divided into two key parts—General Aptitude and Professional Knowledge—each designed to assess different skill sets required for specialist roles.

The structure below gives a clear overview of the sections, number of questions, marks distribution, and time allotted for each paper.

Paper 1: General Aptitude

| Subjects | Number of Questions | Maximum Marks | Duration |

|---|---|---|---|

| Reasoning | 15 | 15 | 45 Minutes (Overall) |

| English Language | 15 | 15 | |

| Quantitative Aptitude | 20 | 20 | |

| Total | 40 | 40 | 45 Minutes |

Paper 2: Professional Knowledge

| Section | Number of Questions | Maximum Marks | Duration |

| General IT Knowledge | 60 | 100 | 75 Minutes |

Important Points

- The General Aptitude Paper is qualifying in nature—marks from this section are not counted in the final merit list.

- There is no negative marking in the online written exam.

How to Apply for SBI SO 2026?

✅ Visit the Official Website

Go to SBI Careers → Current Openings (https://bank.sbi/web/careers/current-openings).

✅ Online Registration

Create your account by entering basic details and generating a login ID and password.

✅ Fill the Application Form

Log in and complete the form with your personal, educational, and professional information.

✅ Upload Required Documents

Attach the necessary files such as:

- Photograph & Signature

- Resume

- ID & Age Proof

- Educational Certificates

- Experience Certificates

- Caste/PwBD Certificate (if applicable)

- Form-16/Offer Letter/Salary Slip

- NOC (for government/PSU employees)

✅ Pay the Application Fee

Make the payment online using debit/credit card, UPI, or net banking.

✅ Final Submission

Review your form, submit it, and ensure everything is correct.

✅ Save a Printout

Download and print the submitted application for future use.

Conclusion

The SBI SO Recruitment 2025 offers a valuable opportunity for candidates aiming to build a career in specialised banking roles. With clearly defined eligibility criteria, a structured selection process, and a growing demand for domain experts, this recruitment drive opens the door to rewarding positions across wealth management, customer relations, IT, and more.

Understanding the exam pattern, age limits, qualifications, and application steps will help aspirants prepare strategically and confidently.

As the banking sector continues to evolve, Specialist Cadre Officers play a crucial role in shaping its future—making this an excellent pathway for professionals looking to contribute their expertise to India’s largest public sector bank.